Coinbase CEO: If U.S. debt gets out of control, Bitcoin may replace the dollar as the world's reserve currency

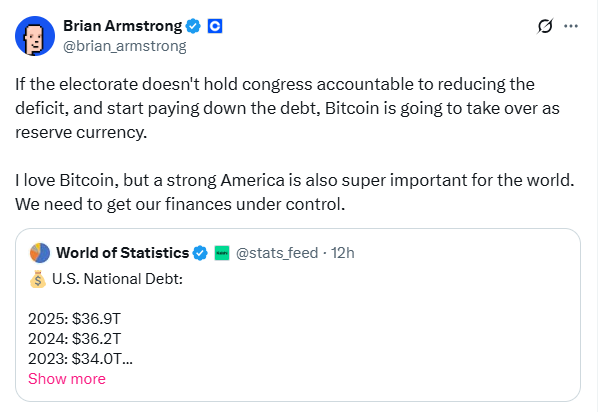

Today, Coinbase CEO Brian Armstrong made a comment on the social platform X, warning that if the US government fails to effectively control the fiscal deficit and initiate a national debt repayment mechanism, it may face a situation where Bitcoin replaces the US dollar as the global reserve currency.

"I love Bitcoin, but I also believe that a strong United States is equally important to the world," Armstrong wrote. He stressed that the United States needs to take action as soon as possible to "take control of its own fiscal situation," otherwise the dollar's global dominance may be shaken.

These remarks come at a time when the U.S. Congress continues to be deadlocked on issues such as the debt ceiling and fiscal spending. Data from the first quarter of 2025 showed that the U.S. federal debt has exceeded $35 trillion, accounting for a record high as a percentage of GDP. Market concerns about long-term debt sustainability are rising, which has also prompted Bitcoin to once again become the focus of discussion as a safe-haven asset.

As one of the largest cryptocurrency trading platforms in the United States, Coinbase has been an important driving force for the mainstreaming of Bitcoin. Armstrong's remarks not only reflect the cryptocurrency industry's concerns about current fiscal policies, but also reveal the trend of digital assets gradually being linked to macroeconomic policies.

In recent years, Bitcoin has been regarded as "digital gold" by more and more institutions due to its anti-inflation characteristics and limited total amount. Since 2025, many companies and government entities have publicly announced that they will include Bitcoin in their reserve assets, including El Salvador, the United Arab Emirates and some U.S. companies and state governments.

It is worth noting that although Armstrong recognizes Bitcoin's long-term potential for value storage, he also made it clear that this is not what he wants to see. "The stability and influence of the US dollar remain vital to the global financial system. We should not passively wait to be replaced by digital currencies."