Dubai real estate transactions hit record growth, indicating that it is time for real estate tokenization

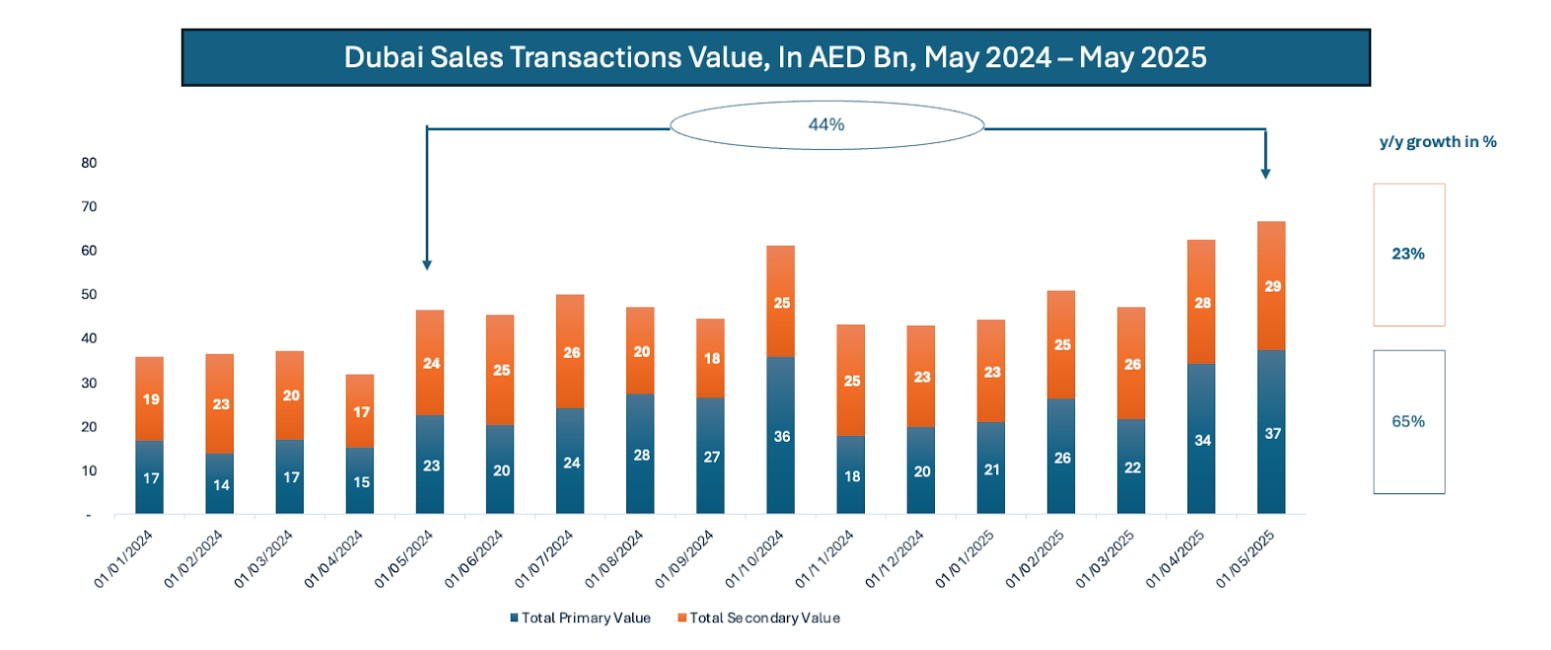

In May 2025, Dubai's real estate market ushered in an unprecedented highlight: according to data released by the real estate platform Property Finder, the monthly transaction volume reached 18,700, with a total sales volume of 66.8 billion dirhams (about 18.2 billion US dollars), setting a record high. This amazing achievement not only reflects the strong market demand, but is also seen as a signal of accelerated landing of real estate tokenization, indicating that Dubai's potential in the field of real world assets (RWA) has been further activated.

Data shows that this round of growth is driven by both the primary and secondary markets. Among them, sales in the primary market soared 314% year-on-year, showing the popularity of new projects; the secondary market also grew by 21%, showing the stable appeal of mature properties. This comprehensive prosperity has built a highly liquid and capital-active market ecology, providing an ideal test field for the segmentation, digitization and tokenization of real estate assets.

Scott Thiel, co-founder and CEO of Tokinvest, pointed out that Dubai's market performance is not only a reflection of economic activity, but also a positive response to real estate innovation. He believes that real estate tokenization has moved from the "concept stage" to the reality process, and by splitting real estate into smaller, affordable shares, it will greatly expand the participation space of local and international investors. "Tokenization is not only a product of market development, but will in turn accelerate the next wave of growth in the market." Thiel said.

It is worth noting that the promotion of Dubai's real estate tokenization is not only driven by the market, but also has strong support from policies and regulators. In early May, MultiBank Group, MAG Real Estate and blockchain platform Mavryk signed a $3 billion RWA agreement to bring luxury housing projects to the chain; then, the Dubai Virtual Asset Regulatory Authority (VARA) updated regulations to provide a compliant path for the issuance and trading of tokenized real estate assets; at the end of the month, the Dubai Land Department, the Central Bank of the United Arab Emirates and the Dubai Future Foundation jointly launched the first official platform supporting tokenization, allowing investors to hold digital shares of "Dubai ready homes".

Overall, Dubai is building a real estate tokenization ecosystem that covers the intersection of policy support, technological foundation and market demand. Against the backdrop of surging liquidity and increasingly clear regulatory frameworks, this Middle East fintech capital is accelerating its pace to become a pioneer city in the global real estate asset chain.