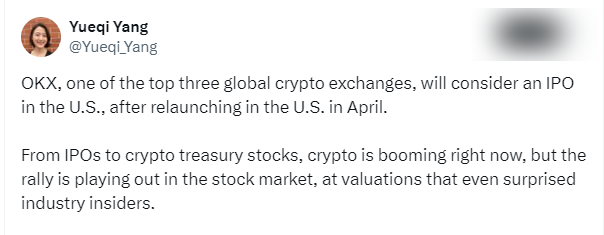

OKX considers IPO in the U.S., accelerating expansion after returning to the U.S. market

According to people familiar with the matter, cryptocurrency trading platform OKX is actively considering an initial public offering (IPO) in the United States, which is another major strategic deployment of the company after returning to the U.S. market in April this year.

OKX is one of the world's leading digital asset trading platforms and has rapidly expanded its international business in the past few years. Against the backdrop of global crypto regulation becoming clear by the end of 2023, OKX chose to re-enter the U.S. market in April 2025, indicating that its confidence in the U.S. regulatory environment is recovering.

According to sources, OKX is currently in contact with several investment banks to evaluate the feasibility and timing of listing in the US market. Although the specific timetable for the IPO has not yet been finalized, the company has begun to plan relevant compliance and preparation work.

The IPO plan comes at a time when the US regulation of crypto assets is becoming more rational and standardized. Since the beginning of this year, US regulators have promoted legislation such as the Crypto Asset Market Structure Act (GENIUS Act) to provide a clear regulatory framework for the industry. At the same time, more and more crypto companies such as Coinbase and Circle have sought recognition and support from traditional capital markets through listings and other means.

Analysts pointed out that if OKX is successfully listed, it will further enhance its brand influence and user trust in the global market and provide financial support for its diversified product layout. OKX has currently obtained virtual asset-related licenses in Asia, Europe, the Middle East and other regions, and is actively deploying ecological products such as Web3 infrastructure, on-chain wallets, and DeFi.

However, it is worth noting that crypto companies still face a high review threshold for listing in the United States, especially in terms of compliance, asset transparency and user protection. OKX previously suspended its operations due to failure to meet regulatory requirements in some regions. If it can successfully complete the IPO, it will mark a major progress in its compliance system.

As of press time, OKX officials have not yet made a public statement on the IPO plan.