JPMorgan Chase and DBS are targeting deposit tokens, aiming to create a cross-bank stablecoin alternative.

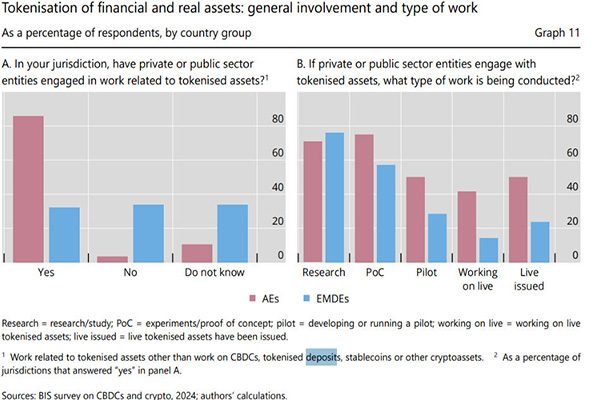

A survey by the Bank for International Settlements (BIS) shows that by 2024, at least one-third of commercial banks were exploring or piloting deposit tokenization.

Leading financial institutions are continuing to explore blockchain technology to achieve more economical and faster institutional payment processes, demonstrating a growing interest in tokenization solutions.

US investment bank JPMorgan Chase and Singapore-based multinational banking group DBS Bank announced on Tuesday that they are jointly developing a blockchain-based tokenization framework aimed at enabling on-chain transfers between their deposit token ecosystems. The project aims to establish a new industry standard for cross-bank digital payments.

This tokenization framework will enable the two financial institutions to make instant payments 24/7 on public and permissioned blockchain networks, providing their institutional clients with a wider range of cross-bank on-chain transaction services.

DBS Bank stated that the new framework will allow institutional clients of both banks to exchange or redeem tokenized deposits on public and permissioned blockchain networks and make real-time cross-border payments. The system is designed to operate 24/7, providing what DBS Bank calls "24/7 availability."

This new interoperability framework emerges against the backdrop of growing institutional interest in tokenized financial solutions. These solutions are part of the broader field of tokenized real-world assets (RWA), designed to bring financial and physical assets to the blockchain to enhance investors' access to assets.

According to a 2024 survey by the Bank for International Settlements (BIS), at least one-third of the surveyed commercial banks had launched, piloted, or researched tokenized deposits.

Financial institutions are exploring tokenized deposits. Source: bis.org

Banks are pushing for interoperability in tokenized finance

Several top Swiss banks, including UBS, PostFinance, and Sygnum Bank, are also exploring blockchain-based interbank payment systems.

These institutions completed their first legally binding blockchain-based payment on September 16, demonstrating the technology's effectiveness for bank deposits and institutional payments.

Rachel Chew, Group Chief Operating Officer and Head of Digital Currency at DBS Bank's Global Transaction Services division, points out that establishing an interoperability framework is crucial to reducing fragmentation in tokenized cross-border fund transfers.

"Our partnership with JPMorgan's Kinexys to develop an interoperability framework is a significant milestone in the realm of cross-border money flows," Chew stated. She added that instant, 24/7 payments will provide businesses with more "selectivity, flexibility, and speed to navigate global uncertainty and capitalize on emerging opportunities."

The announcement of this new framework comes just two weeks after JPMorgan completed its first transaction on its upcoming tokenization platform, Kinexys Fund Flow, which Cointelegraph reported on on October 30.

The investment bank plans to launch its tokenization platform in 2026 and intends to tokenize more assets, including private credit and real estate.

JPMorgan and DBS are also major backers of Patrio, a blockchain-based settlement network and payment platform that raised $60 million in funding in July 2024.