Tokyo Stock Exchange Operator JPX Considers Tightening Listing Rules for Cryptocurrency Treasury Companies

Metaplanet CEO Simon Gerovich stated that the Japan Exchange Group (JPX)'s concerns focus on companies that have gone public through backdoor listings or have lax approval processes, and insisted that this criticism does not apply to them.

Japan's largest stock exchange operator is considering new restrictions on publicly listed companies that are shifting their core business to buying and holding cryptocurrencies, marking a potential shift in one of the most active markets for digital asset treasury (DAT) companies.

According to Bloomberg, citing anonymous sources familiar with internal discussions, the Japan Exchange Group (JPX) is exploring stricter scrutiny of companies that are shifting their core business to large-scale cryptocurrency accumulation. This includes new auditing requirements and stricter assessments for backdoor listings.

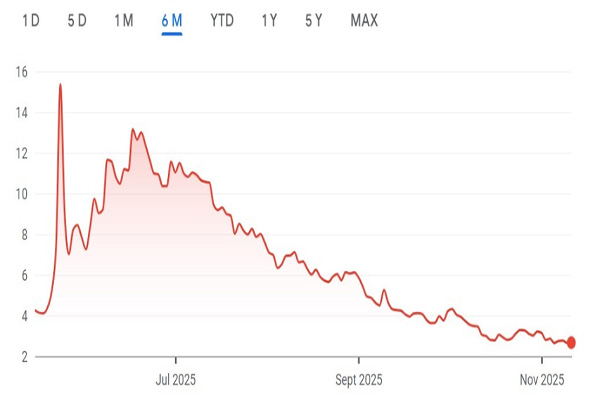

This move comes after a wave of losses for Japanese DAT companies, many of which attracted retail investors earlier this year. Metaplanet, Japan's largest DAT company, holds more than 30,000 Bitcoins (BTC), and its share price has fallen from a year-to-date high of $15.35 on May 21 to $2.66 at the time of writing. This represents an 82% drop from its year-to-date high.

Convano, a Japanese nail salon franchisee, performed strongly in August, currently trading at approximately $0.79 per share, a 61% drop from its August 21 high of $2.05. Data from BitcoinTreasuries.NET shows the company's BTC investment has lost nearly 11%.

Metaplanet six-month price chart. Source: Google Finance

Backdoor Listing Rules to Fill Regulatory Gaps

Applying backdoor listing rules to companies shifting to cryptocurrency accumulation will mark a significant tightening of listing standards in Japan.

A backdoor listing refers to a private company acquiring a listed shell company to bypass the traditional initial public offering (IPO) route, a practice already prohibited by the JPX.

Extending this ban to publicly traded companies shifting to cryptocurrency holding vehicles will fill a regulatory gap that some DAT companies might exploit to evolve their business models.

If the JPX formally restricts such shifts, it could slow down or halt the listing process for new DAT companies.

Metaplanet CEO Emphasizes Governance Measures in Response to JPX Report

Metaplanet CEO Simon Gerovich refuted suggestions that Bitcoin accumulation companies might circumvent governance or disclosure rules. In a post on the X platform, Gerovich responded to the report, stating that JPX's concerns targeted companies suspected of backdoor listings or transitioning to digital assets without proper shareholder approval. He stated that this did not apply to Metaplanet.

"In contrast, Metaplanet has held five shareholder meetings (four extraordinary general meetings and one annual general meeting) in the past two years, and all key matters have been approved by shareholders."

He added that they have also amended their bylaws and increased authorized shares to fund BTC purchases. He stated that the company has adhered to formal governance processes under the same management team that led the company before the transition.