The crypto exchange landscape in 2025 is beginning to emerge: the top ten platforms lead the global market

In the first half of 2025, the cryptocurrency market was calm on the surface, retail investors were in a wait-and-see mood, and the prices of mainstream assets fluctuated in a narrow range. However, behind the market's silence, regulatory promotion, institutional entry and platform innovation are quietly accumulating energy. Especially in the United States, a clear legislative framework for digital assets is becoming increasingly clear, which is expected to release new capital vitality and attract more traditional financial giants to deploy in the crypto field.

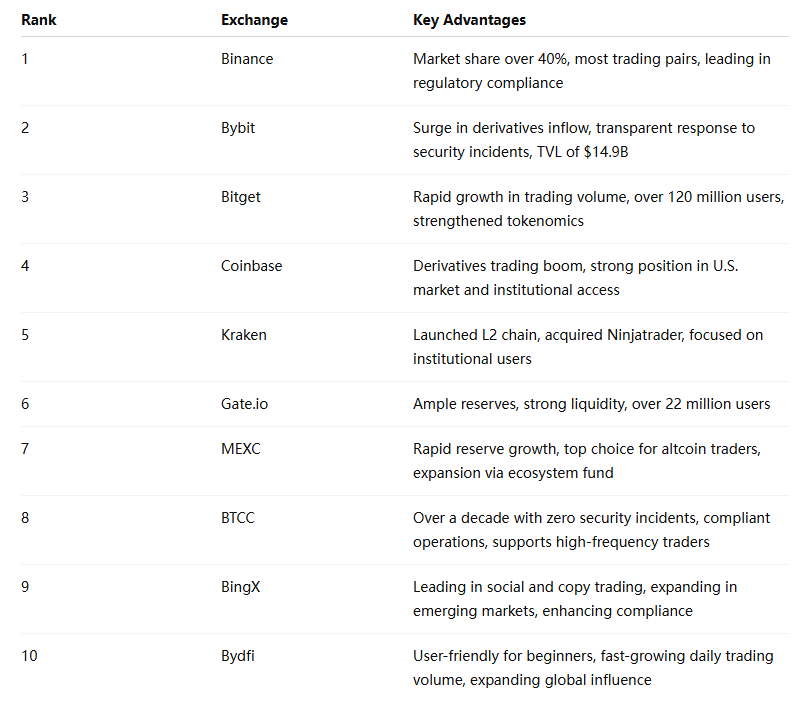

At the same time, centralized exchanges (CEX) play an important role in this critical transition period. From providing liquidity to technological innovation, from user growth to regulatory cooperation, leading platforms are laying a solid foundation for the next wave of market rebound. The following is the comprehensive strength ranking of the top ten cryptocurrency exchanges in 2025 so far, with evaluation dimensions including trading volume, user base, product innovation, global influence and market relevance.

Top 10 Crypto Exchanges in 2025 (Today)

Analysis of each exchange

Binance: The core hub of global liquidity

As the world's largest exchange, Binance's spot trading volume reached $2.2 trillion in the first quarter of 2025, and its market share jumped to 40.7%. The platform supports more than 1,800 trading pairs, covering mainstream coins, meme coins and a variety of derivatives. Binance also actively cooperates with many governments to promote the regulatory framework of crypto assets and helps some countries explore the establishment of national Bitcoin reserves.

Bybit: Derivatives are rising strongly, trust is added

Bybit recorded $3.61 billion in inflows and $14.9 billion TVL in March with its deep cultivation in the high-end derivatives market. The platform showed efficiency and transparency in responding to the security incident in February, without causing any loss of user funds, and quickly processed more than 350,000 withdrawals. Its bug bounty program also accelerated the recovery of some assets and improved market trust.

Bitget: A billion-level platform for social trading

Bitget's trading volume reached $2.08 trillion in the first quarter of 2025, and spot trading increased by 159% year-on-year. The total number of users has exceeded 120 million, making it one of the most growing platforms in the world. Bitget recently updated the BGB token model and carried out its first quarterly destruction to optimize the token ecosystem and enhance value capture capabilities.

Coinbase: Institutionalized bridge to the US market

Coinbase remains a key gateway to the US market, with its daily derivatives trading volume increasing by 6,200% year-on-year. The platform currently supports 106 perpetual futures contracts and continues to expand its product line. With the progress of US crypto regulation, Coinbase will usher in a new round of development dividends with its compliance advantages and institutional channel attributes.

Kraken: Innovation and security are equally important

As an industry veteran, Kraken has a daily spot trading volume of US$283 million and more than 13 million users. Its self-developed Ink Layer L2 chain has expanded its on-chain product capabilities, and enhanced its trading services through the acquisition of Ninjatrader, driving overall revenue growth by 19%.

Gate.io: A "low-key giant" with deep reserves

With a cumulative reserve of more than US$10 billion and a reserve ratio of 128.58%, Gate.io is one of the most solvent exchanges. Its contract trading volume in the first quarter of 2025 increased by 31%, showing strong momentum. The platform continues to optimize the user experience and strengthen its brand presence in multiple core markets.

MEXC: Pioneer in the expansion of the altcoin ecosystem

MEXC's on-chain deposits surged by $390 million in the first quarter of 2025, indicating a rebound in market confidence. Its rich asset types and low fees have attracted a large number of altcoin traders. The platform recently established a $300 million ecological development fund, planning to support the incubation of new projects and community expansion worldwide.

BTCC: A trust benchmark with historical sedimentation

Since its establishment in 2011, BTCC has been known for its high security and long-term stable operation. With a 24-hour trading volume of $2.85 billion in April, its light KYC and globalization strategy have been welcomed. Recently, BTCC has upgraded its VIP program to serve more high-frequency, cross-market professional traders.

Bingx: Copy trading drives community fission

Bingx has established barriers in the field of social trading, especially in the Asian and Latin American markets. Its low-fee strategy and powerful copy trading system attract a large number of new users, and it will launch a global internship program in 2025 to cultivate future talents in the crypto industry.

Bydfi: Simple experience wins emerging markets

Bydfi (formerly Bityard) focuses on user-friendliness, providing a simple interface and low-threshold trading experience. The daily derivatives trading volume in April reached US$27.7 billion, with a growth rate of 19%. It has performed particularly well in the Southeast Asian, Indian and Latin American markets, and has become the official sponsor of the TOKEN2049 Dubai Summit to enhance its international reputation.

Still waters run deep, and storms will rise

Although the crypto market is still in the accumulation period in 2025, the top exchanges have launched a new round of competition in technology layout, user acquisition and globalization. When the policy is clear, capital returns, and confidence recovers, these trading platforms will become the engine of the new market cycle. Who can seize the opportunity and stand out in the future crypto wave? The answer may be revealed in the next quarter.