Cryptocurrency market suffers a wholesale sell-off. What caused this plunge?

Since Bitcoin fell below the $90,000 mark on February 25, the cryptocurrency market has plummeted, and the market has been like a slide, going downhill all the way. In the early hours of this morning, Bitcoin fell to around $82,200, a new low since November 12, 2024; Ethereum also fell to around $2,100, erasing all gains since August 2024.

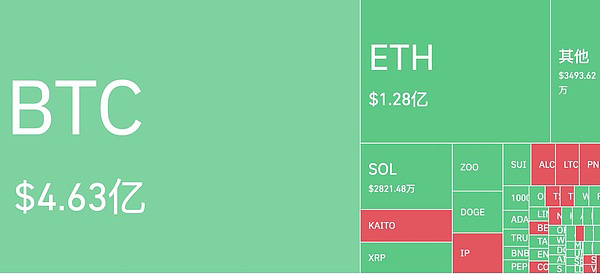

According to Coinglass data, as of press time, the total amount of liquidation in the entire network in the past 24 hours exceeded US$772 million, of which Bitcoin and Ethereum accounted for 60% and 17% respectively, and a large number of altcoin long positions were also collectively liquidated in these two days.

As market sentiment continues to be in a state of "extreme panic", despite the huge decline in Bitcoin and Ethereum, there is still no sign of stopping the decline. So the question is, what caused this round of plunge in the cryptocurrency market?

Based on a variety of factors and analysis, the author believes that this market crash may be a "panic stampede" phenomenon caused by the resonance of multiple negative factors.

Macroeconomic factors

At the macro level, we can look at factors such as the impact of uncertainty in Trump’s recent policies, the U.S. stock market bubble, and the failure of the Federal Reserve’s interest rate cut expectations.

First, although Trump has publicly expressed his support for Bitcoin as a "strategic reserve asset", he has not actively promoted the formulation of relevant cryptocurrency policies since taking office. But in fact, long before Trump took office, the market had been pushed to the peak by various optimistic expectations of investors. As Trump continues to promote tariff plans (such as imposing tariffs on imported goods from Mexico and Canada), some analysts pointed out that this has aroused people's concerns about the trade war, which has led to an increase in risk aversion, resulting in investors choosing to sell high-risk assets such as Bitcoin.

In addition, the review process of US state-level Bitcoin-related bills has also begun to be blocked. Currently, more than 30 states in the United States have proposed bills involving strategic Bitcoin reserves and digital asset investments, but some state governments have rejected related proposals. The most influential one is the South Dakota legislature's seemingly postponed but actually killed the "Allowing State Governments to Invest in Bitcoin Bill". At the same time, the strategic Bitcoin reserve bills proposed by Montana and Wyoming were also rejected.

This series of events also exposed the differences between the Trump administration and state-level policies. Investors suddenly found that the passage of the Bitcoin bill did not seem as smooth as they had imagined. When expectations were dashed again and again, it would undoubtedly undermine the market's confidence in the Trump administration's "Crypto-friendly" commitment to a certain extent.

On the other hand, the U.S. stock bubble and the Federal Reserve’s interest rate cut are nowhere in sight and have also had an impact on the cryptocurrency market.

According to China Business News, as of February 26, U.S. stocks have been sold off for four consecutive days, and popular star technology stocks have plunged from high positions, with cumulative declines ranging from 10% to 35%. Some analysts pointed out that this selling sentiment for highly valued technology stocks is also gradually spreading to the field of cryptocurrency. Investors are worried about the bursting of the U.S. stock bubble, and risk appetite is rapidly declining, causing funds to withdraw from high-volatility assets such as Bitcoin and Ethereum. At the same time, the Federal Reserve has been slow to cut interest rates. In a high-interest environment, the attractiveness of the U.S. dollar as a global reserve currency has been enhanced, which has caused some funds to flow back from risky assets such as cryptocurrencies to U.S. dollar assets.

Cryptocurrency market is plagued by "negative buff"

The cryptocurrency market has been facing internal and external troubles recently, and is covered with "negative buffs".

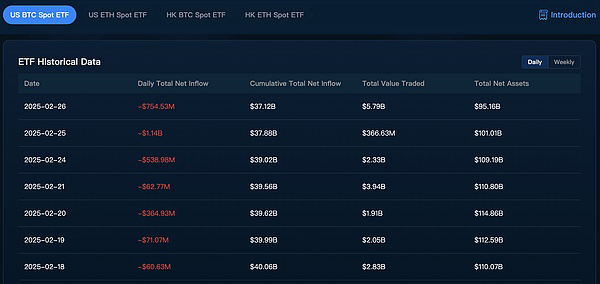

Since February this year, Bitcoin spot ETFs have experienced a serious "bleeding effect". As an important inflow channel for institutional funds, its capital flow data is also one of the key indicators affecting market confidence. However, throughout February, Bitcoin spot ETF funds were almost net outflows, including large net outflows of over US$100 million.

According to iChaingo data, the U.S. Bitcoin spot ETF experienced net outflows for seven consecutive days from February 18 to 26, Eastern Time. On February 25, the net outflow was as high as US$1.14 billion, setting a record for the largest single-day net outflow since its launch. This inevitably reflects the pessimistic expectations of institutional investors on short-term price trends.

In contrast, although the situation of Ethereum spot ETF is better than that of Bitcoin, it also experienced five consecutive days of net outflow from February 20 to 26. However, the negative factors facing Ethereum are not limited to this.

In fact, Ethereum has long been stuck in a capacity expansion dilemma, which is also the main reason for its relatively low price in the past two months. Ethereum plans to alleviate the capacity expansion problem through the Pectra upgrade, but the upgrade launch process is not smooth. According to CoinDesk, the Ethereum Pectra upgrade was activated on the Holesky test network but ultimately failed to be confirmed. As of now, Ethereum officials have not announced the reason why the test network failed to complete.

In addition, Solana, which was once in the limelight with Meme coins, has also suffered multiple blows recently. Under the successive destruction of Trump's Meme coin TRUMP and the Meme coin LIBRA promoted by the Argentine president, the potential value of the Meme coin market has been severely reduced, and a large number of investors have lost interest in Meme coins. There are even many analysts who believe that the Meme coin craze is coming to an end. Because of this, the Meme coin market that Solana relies on has also entered a state of sluggishness.

What is even more worrying is that Solana is about to usher in the largest-scale SOL token unlocking "storm". According to Cointelegraph, Solana will unlock more than 11.2 million SOL tokens (worth about $2 billion) on March 1, which will undoubtedly make the SOL market "worse". Crypto analyst Artchick.eth analyzed that "over 15 million SOL (about $2.5 billion) are expected to enter the circulation market in the next three months." Affected by this, SOL once fell to around $130, setting a new low since September 18, 2024.

Frequent hacker attacks

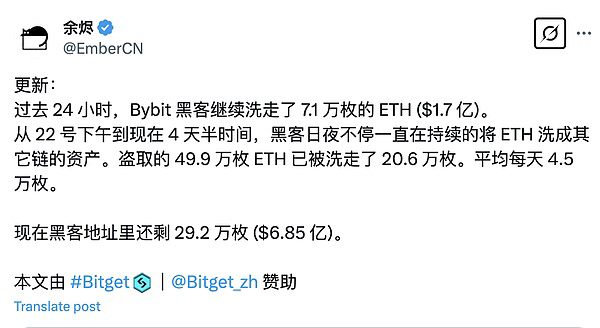

Late at night on February 21, the cryptocurrency trading platform Bybit was hacked, and more than 400,000 Ethereum and stETH (total asset value of more than 1.5 billion US dollars) were stolen, becoming the largest theft in the history of the cryptocurrency circle. It also raised questions about the security of cryptocurrencies and triggered panic selling by a large number of investors. Although Bybit has tried to minimize the negative impact, the huge amount of Ethereum stolen by hackers has undoubtedly become a "mine" that affects the market.

As of writing, according to monitoring by X user Yu Jin, in the past 24 hours, the address marked as the Bybit hacker has laundered about 71,000 Ethereum (worth about $170 million). So far, the amount of Ethereum laundered has reached about 206,000, but the hacker address still holds 292,000 Ethereum (worth about $685 million). Previously, Yu Jin said that the hacker expected to convert all the remaining ETH into other assets (such as BTC, DAI, etc.) within half a month.

In addition to Bybit, the stablecoin payment platform Infini was also hacked on February 24, and nearly $50 million of crypto assets were stolen. Although the amount of theft is far less than the former, the occurrence of hacker incidents one after another has not only hit investors' confidence, but also had a direct impact on the market.

In summary, this round of decline is not only the adjustment of market demand, but also the comprehensive response of the market to the withdrawal of institutional funds, macroeconomic policy impact, hacker incidents and bubble burst. The author believes that, in essence, the continuous rise of cryptocurrencies such as Bitcoin since the end of 2024 has accumulated a lot of profit-taking, but since the beginning of February, the price of Bitcoin has continued to fluctuate in the range of 90,000 to 100,000 US dollars, failing to break through the resistance level, and lacking major support, so even if there is no major negative factor, the selling of these profit-taking will also put great pressure on the market price.

However, although the current market has been hit by multiple factors, it is still too early to assert that the "bull market is over."

Yu Jianing, co-chair of the Blockchain Committee of the China Communications Industry Association, said in an interview with Beijing Business Daily that "the current decline is likely to be a technical adjustment rather than a long-term trend reversal." The author believes that in the short term, we need to be wary of the risk of further bottoming out caused by the sell-off crisis, but in the medium and long term, the market may lay the foundation for a new cycle after clearing. In addition, if the Trump administration proposes cryptocurrency-related policies and the U.S. state strategic Bitcoin bill is passed, it will inevitably bring unpredictable developments to the entire cryptocurrency market.