Solana’s Volume Drops 99% – Why Strong Accumulation Matters Now

Amid the tariff-induced market sell-off, Solana [SOL] plunged 15.56% in a single day, falling below pre-election levels and breaching key support at $150. In fact, among high-cap assets, SOL led the decline with a weekly loss of nearly 20%.

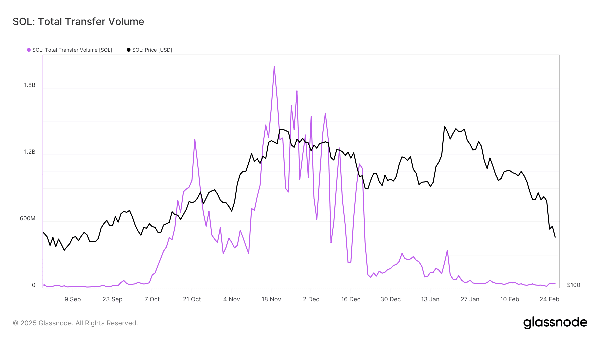

Meanwhile, on-chain transfer volume also plummeted to $14.5 million, a 99% plunge from its November peak of $2 billion.

With on-chain metrics cooling, does SOL face a deeper correction, or will buyers step in to defend key support levels?

Solana’s Volume Faces a Critical Make-or-Break Moment

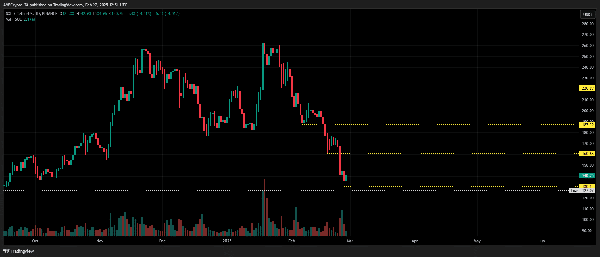

It has never been more important for SOL to hold key support levels. With 100% of post-election gains wiped out, the risk is at an all-time high.

Since Trump drove the memecoin to a surge and peaked at $295.83, Solana has failed to establish a solid support base, leaving it facing “extreme” downside risk.

Meanwhile, crypto analyst Ali Martinez highlighted that Solana’s volume metrics have fallen sharply, further weakening its price structure.

Source: Glassnode

SOL is trading at $139.70 at press time and is currently facing a critical inflection point. Successfully turning this level into support will be critical to restoring market confidence.

Failure to do so could force long-term holders (LTH) to capitulate, especially considering that Solana’s market cap has evaporated by nearly $40 billion this month alone.

While Solana’s volume data seems to indicate no immediate supply crunch, excess liquidity remains a key concern. With nearly $1 billion in total locked value (TVL) evaporating, a sustained recovery may remain elusive — at least in the short term.

What’s next for Solana?

In previous cycles, bulls failed to step in at the trough, leading to a sustained pullback in SOL. This means that the weaker holdings have been eliminated, potentially setting the stage for a new cycle high.

Source: TradingView (SOL/USDT)

Solana’s on-chain volume metric reinforces this outlook, surging double-digits to $5.28 billion.

However, further confirmation will be needed in the coming days to confirm a sustained trend reversal. If buying momentum fails to sustain, the 99% drop in Solana transfer volume, coupled with weak bullish support, could make this move a short-term profit-taking opportunity rather than a long-term accumulation phase.

For a meaningful rally to occur, strong accumulation will be essential to trigger a supply shock while absorbing excess liquidity in the market.

Solana’s volume metric will be a key indicator to confirm a potential trend reversal in the coming days.