S&P Global launches Digital Markets 50 index to track cryptocurrencies and blockchain stocks

S&P Global plans to launch a new benchmark index tracking a broad range of digital asset and blockchain-related companies, signaling growing recognition of the cryptocurrency industry within traditional finance.

S&P announced Tuesday that the S&P Digital Markets 50 Index, created in partnership with tokenization firm Dinari, will include 15 cryptocurrencies with a market capitalization of at least $300 million and 35 publicly traded companies in the sector with a market capitalization of at least $100 million.

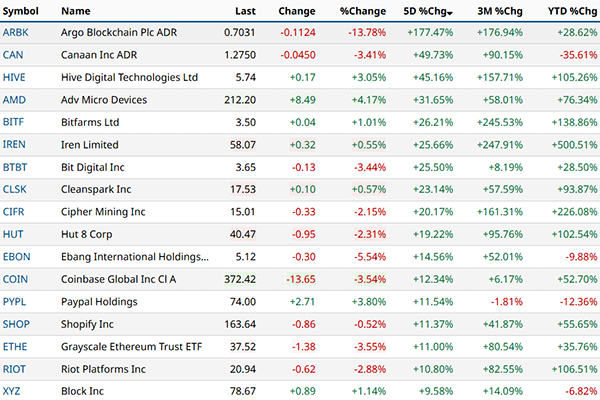

The constituents have not yet been announced, but no single stock will account for more than 5% of the index. Some of the largest companies in the sector include Bitcoin treasury firm Strategy (MSTR), cryptocurrency exchange Coinbase (COIN), and Bitcoin mining company Riot Platforms (RIOT).

A selection of cryptocurrency and blockchain-related stocks, including Bitcoin mining, exchanges, and payment platforms. Source: Barchart

Cameron Drinkwater, Chief Product and Operating Officer at S&P Dow Jones Indices, stated that the growth of the digital asset ecosystem has moved cryptocurrencies "from a marginal position to a more established role in global markets."

While indices cannot be invested in directly, they serve as key benchmarks for tracking market performance and often underpin exchange-traded funds (ETFs) and other investment products.

Dinari plans to issue a tokenized version of the index, called "dShares," which will allow investors to gain direct exposure. The investable version is expected to be available by the end of 2025.

Indexing Signals the Next Wave of Cryptocurrency Acceptance

One of the key implications of S&P's entry into cryptocurrency indexing is that passive ETFs could one day track the performance of a 50-digit digital market index, much like traditional index funds mirror stock benchmarks.

For example, the SPDR S&P 500 ETF tracks the S&P 500, allowing investors to gain broad market exposure through a single product.

Several cryptocurrency index funds already exist. The Bitwise 10 Cryptocurrency Index Fund (BITW) tracks the Bitwise 10 Index, which includes the largest digital assets by market capitalization.

Similarly, Hashdex Nasdaq Cryptocurrency Index products—including Brazil's HASH11 and the US-based Hashdex Nasdaq Cryptocurrency Index US ETF (NCIQ)—track the Nasdaq Cryptocurrency Index, providing diversified exposure to major cryptocurrencies through a regulated exchange-traded product.

Meanwhile, recognition of tokenization as a transformative financial technology is growing.

As Cointelegraph recently reported, the U.S. Securities and Exchange Commission (SEC) is reportedly exploring a framework that would allow stocks to be traded as tokenized assets on blockchain networks, potentially bringing traditional securities closer to cryptocurrency-style infrastructure.