Peter Brandt: Bitcoin (BTC) will see a "dramatic" price surge if it doesn't peak at a critical time

Veteran trader Peter Brandt said Bitcoin could see "dramatic" price action if it deviates from its four-year cycle.

BitMEX co-founder Arthur Hayes agrees that the four-year cryptocurrency cycle is dead, but not for the reasons most people believe.

"As the fourth anniversary of the fourth cycle approaches, traders are looking to apply historical patterns and predict the end of this bull market," Hayes said in a blog post on Thursday.

He added that while the four-year pattern worked in the past, it no longer applies and "will not work this time."

Hayes believes Bitcoin price cycles are driven by the supply and volume of money, primarily the US dollar and the Chinese yuan, rather than any arbitrary four-year pattern tied to halving events or a direct result of institutional interest in cryptocurrencies.

Hayes said past cycles ended when monetary conditions tightened, not due to timing.

The Current Cycle Is Different

Hayes believes this cycle is different for several reasons, including the US Treasury's release of $2.5 trillion from the Federal Reserve's reverse repo program by issuing more Treasury bonds, and President Trump's desire to "run full steam ahead" with looser monetary policy to grow debt-free.

There are also plans to relax bank regulations to increase lending.

Furthermore, the US Federal Reserve has resumed interest rate cuts despite above-target inflation. According to the CME futures market, two more rate cuts are expected this year, with a 94% probability of an October cut and an 80% probability of another in December.

The Key Lies in US and Chinese Money Printing

Bitcoin's first bull run, which coincided with the Fed's quantitative easing and China's credit expansion, ended in late 2013 when both the Fed and the People's Bank of China slowed money printing.

The second "ICO cycle" was primarily driven by the 2015 credit boom and currency devaluation of the RMB, not the US dollar. He says the bull run collapsed as Chinese credit growth slowed and US dollar conditions tightened.

During the third "coronavirus cycle," Bitcoin soared solely on US dollar liquidity, while China remained relatively restrained. Hayes explained that the cycle ended when the Fed began tightening policy in late 2021.

China Won't Kill the Cycle This Time

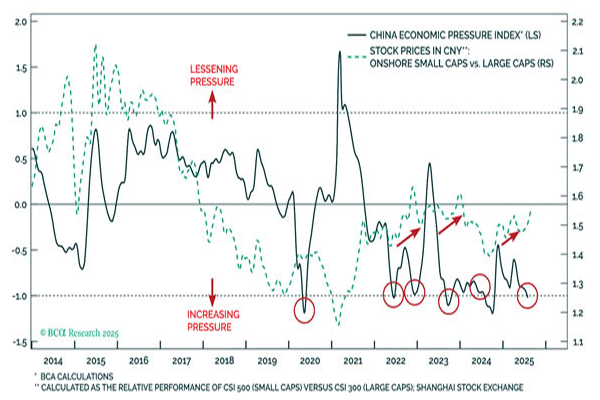

Hayes argues that while China won't drive this rally as hard as in previous cycles, policymakers are taking action to "end deflation" rather than continue to pump liquidity.

He argues that this shift from deflationary pressures to at least neutral or mildly supportive monetary policy removes a major obstacle that would otherwise kill the cycle, allowing US monetary expansion to drive Bitcoin higher without being offset by Chinese deflation.

Listen to our monetary gurus in Washington and Beijing. They clearly state that money will become cheaper and more plentiful. Consequently, BTC continues to rise in anticipation of this highly likely future. The old king is dead, long live the new king!

Arthur Hayes says Chinese policymakers print money when economic pressures become too intense. Source: Arthur Hayes

Many Still Believe in the Four-Year Cycle

On-chain analytics firm Glassnode stated in August that "from a cyclical perspective, Bitcoin's price action also echoes previous patterns."

“I think in terms of the four-year cycle, the reality is that we’re likely to continue to see some form of cycle,” Saad Ahmed, head of Asia Pacific for cryptocurrency exchange Gemini, told Cointelegraph earlier this month.