The Trump administration will provide "tens of billions of dollars" for the construction of nuclear power plants.

To address the massive electricity shortage caused by the development of artificial intelligence, the Trump administration is planning to use "tens of billions of dollars" of national funds to finance the construction of new nuclear power plants. This move aims to secure the energy base needed for the AI revolution and positions the government as the ultimate financial backer for this crucial industry.

According to Reuters, U.S. Energy Secretary Chris Wright stated at a conference hosted by the American Nuclear Society that the Department of Energy's Loan Program Office (LPO) will allocate the vast majority of its funds to support nuclear power plant construction. The LPO has the authority to provide hundreds of billions of dollars in financing assistance, including loan guarantees for projects that have difficulty obtaining bank loans.

This policy statement directly addresses a core market concern: where will the massive energy infrastructure investment needed to meet the enormous power demands of AI data centers come from? Without strong government intervention, the current AI boom may be unsustainable due to energy bottlenecks. Chris Wright has set a clear goal: to see "dozens of nuclear power plants under construction" by the time we leave office "three years and three months from now."

This move also marks a continuation of a series of pro-nuclear power policies. Previously, President Trump signed an executive order in May requiring the construction of 10 large nuclear reactors by 2030. This clarifies the government's strategic direction of addressing AI's power needs through nuclear energy, and a series of debt financing agreements are expected to be finalized in the coming weeks and months.

Government Steps In to Fill AI Energy Funding Gap

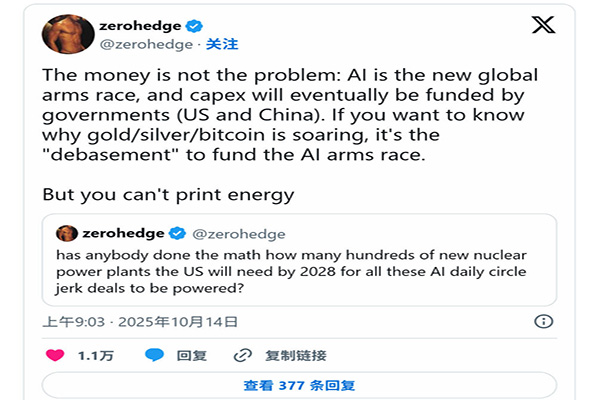

The exponential growth of AI is putting unprecedented pressure on the US power grid, behind which lies a huge funding gap.

According to previous calculations by Morgan Stanley, by 2028, the US will need at least 36 gigawatts (GW) of new electricity to support data center operations, and this figure is almost certainly higher today. With an estimated cost of $50 billion to $60 billion per gigawatt of electricity, the investment demand for energy infrastructure in the coming years will reach trillions of dollars, and this funding is not yet in place.

Chris Wright's statement signifies that the U.S. government will proactively assume the role of filling this gap. He stated that electricity demand from the AI sector will attract "reputable suppliers" to invest billions of dollars in equity capital to build new nuclear power capacity. The Department of Energy's lending office can provide low-cost debt financing to these private capital entities, with matching ratios up to four to one. This public-private partnership model aims to leverage and accelerate the implementation of nuclear power projects.

The U.S. government's determination to promote nuclear power construction also stems from its relatively stagnant state in this field; currently, the U.S. has no commercial nuclear reactors under construction. During Trump's first term, the LPO was only used once to finance the Vogtle nuclear power plant project in Georgia. Now, the government's ambitions extend far beyond that.

Chris Wright hopes to see dozens of projects start simultaneously before his term ends, a goal not only for the government but also for all hyperscale cloud service providers. As OpenAI CEO Sam Altman stated, the market widely expects the US government to act as a "guarantor of last resort." If these nuclear power plants cannot be built, the article cites the view that the AI bubble could burst in a dramatic fashion.

Tech Giants and Westinghouse's Strategy

Guided by government signals, the private sector has begun actively deploying resources. Tech giants including Alphabet, Amazon, Meta Platforms, and Microsoft are investing billions of dollars to restart old nuclear power plants, upgrade existing facilities, and deploy new reactor technologies.

Among them, nuclear power technology giant Westinghouse Electric has become a key player. Last month, the Trump administration reached an agreement with Westinghouse Electric's parent company—uranium miner Cameco and Brookfield Asset Management—to invest $80 billion in building nuclear power plants across the United States. Westinghouse Electric CEO Dan Sumner stated in July that the company would respond to the government's call by adopting its modernized AP1000 reactor design, which can power more than 750,000 homes. Cameco's Chief Operating Officer, Grant Isaac, also confirmed to investors that the government has various tools available to facilitate financing for Westinghouse's reactors, and stated that the market has "strong interest" in this minimum $80 billion investment.

A History of Cost Overruns Creates New Opportunities for SMRs

Despite the promising prospects, the construction of large nuclear power projects is fraught with challenges, particularly cost control. Westinghouse has faced difficulties in delivering its AP1000 reactors on time and within budget. A stark example is its 2017 bankruptcy filing due to cost overruns on major projects in Georgia and South Carolina, highlighting the capital-intensive and high-risk nature of nuclear power construction.

This history has also opened the door to more cost-effective alternatives, such as Small Modular Reactors (SMRs) developed by companies like Oklo and Nano Nuclear. These smaller, lower-cost projects could effectively compensate for the long construction cycles and massive investments required for large reactors.

Meanwhile, according to the terms of the agreement in October, Westinghouse Electric may be spun off into an independent publicly traded company in the future, at which time the U.S. government may become one of its shareholders, so as to more deeply bind government credit to the success or failure of the project.