We found 50 articles related to "gold"

Amazon releases AI chip Trainium 3; cryptocurrency mining companies pivot to participate in the "GPU gold rush."

Amazon recently officially launched its next-generation AI training chip, Trainium 3, which boasts four times the training speed of its predecessor.

Goldman Sachs Releases 10-Year Investment Outlook: Artificial Intelligence and Emerging Markets to Become Core Engines

Goldman Sachs Releases 10-Year Investment Outlook: Artificial Intelligence and Emerging Markets to Become Core Engines

Tether spends huge sums to poach talent from HSBC to increase its gold reserves.

Tether, the world's largest stablecoin issuer, is hiring two top global precious metals traders from HSBC Holdings to further expand its presence in the precious metals market.

Zhaojin Mining officially enters the gold RWA tokenization field and reaches a cooperation agreement with Ant Financial.

according to Hong Kong-based Zhaojin Mining Co., Ltd., during the Hong Kong Fintech Week held on November 3rd, 2025, Zhaojin Mining and SigmaLayer, a subsidiary of Ant Financial, jointly signed a strategic cooperation memorandum.

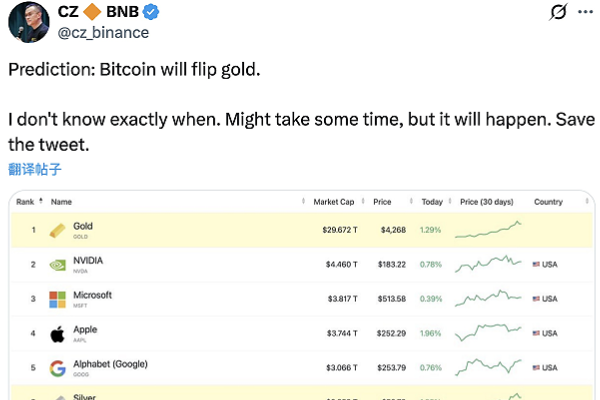

CZ: Bitcoin will eventually replace gold

Binance founder Changpeng Zhao (CZ) recently shared his firm views on Bitcoin's future on social media. He stated, "Bitcoin will eventually replace gold as the mainstream store of value, although I can't give a precise timeline.

Tether CEO: Bitcoin and gold will outlive any other currency

Tether CEO Paolo Ardoino recently published a lengthy article on the social media platform X, elaborating on his unwavering belief in Bitcoin and gold as the ultimate stores of value.

Who created Bitcoin?

In the evolving cryptocurrency landscape, one name stands out as a revolutionary pioneer: Bitcoin. Since its invention in 2008 by an individual or group using the pseudonym Satoshi Nakamoto, Bitcoin (often referred to as "digital gold") has

Spot gold reached $3,750, setting a new all-time high

On September 23rd, the international spot gold market reached another milestone, with gold prices rising above $3,750 per ounce, setting a new all-time high.

Trump places golden statue of himself holding Bitcoin outside US Capitol

A group of supporters of US President Donald Trump has erected a golden statue of himself in a prominent position outside the US Capitol.

Lee Ka-chiu: Hong Kong accelerates the establishment of an international gold trading market

Hong Kong Chief Executive John Lee delivered a new Policy Address in the Legislative Council today (17th). Regarding promoting financial market development, John Lee proposed a number of forward-looking measures aimed at further enhancing H

Matrixport: Macroeconomic and crypto synergies will trigger high volatility in 2026; Mt.Gox repayment and the pre-halving window are key milestones.

04 Jan 2026

Crypto venture capital investment is projected to surge 433% to $49.75 billion by 2025.

04 Jan 2026

NVIDIA and Lenovo have partnered to launch an AI-powered cloud super factory that will utilize Vera Rubin.

07 Jan 2026

Lenovo unveils next-generation AI PC, flagship Motorola smartphone, AI-sensing concept necklace, and concept smart glasses.

07 Jan 2026

Silver's market capitalization reached $4.63 trillion, surpassing Nvidia to become the world's second-largest asset.

07 Jan 2026

China is reviewing whether there were any irregularities in Meta's $2 billion acquisition of Manus.

07 Jan 2026