The second reading of the Hong Kong Legislative Council's "Stablecoin Bill" has started, which is expected to inject a strong shot in the arm for Web3 and financial innovation

On May 21, 2025, the Hong Kong Legislative Council officially launched the second reading debate on the Stablecoin Issuers Bill 2024, marking an important step for Hong Kong to move towards a new era of stablecoin regulation. If the bill is successfully passed, it will establish a statutory licensing mechanism applicable to the issuance and circulation of legal currency stablecoins, bringing a clearer compliance path to the virtual asset industry.

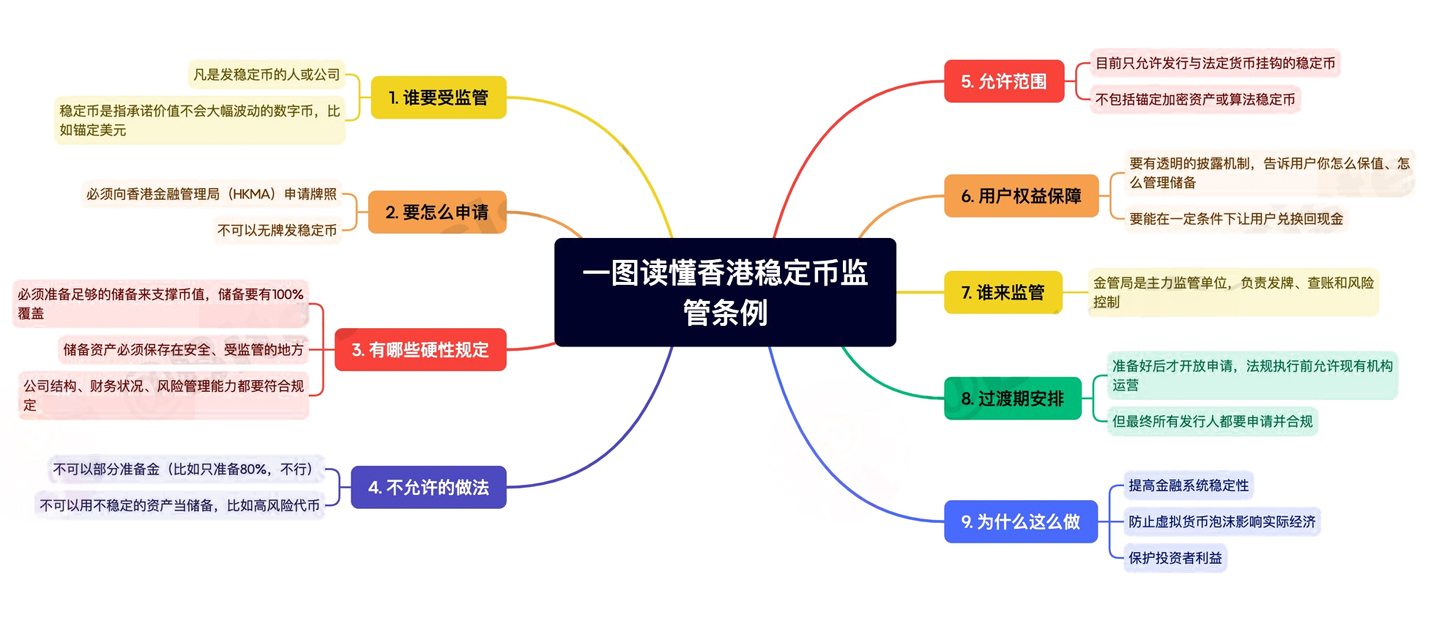

The draft was proposed by the Financial Services and the Treasury Bureau at the end of 2023 and has been subject to public consultation and multiple rounds of review in the past few months. According to the draft, any issuer who wishes to issue a stablecoin pegged to the value of a fiat currency (such as the Hong Kong dollar or the US dollar) in Hong Kong, or promote such tokens to the Hong Kong public, must obtain a license issued by the Monetary Authority. The draft also gives regulators powers including investigation, law enforcement, and revocation of licenses to ensure that stablecoin projects do not pose a risk to the stability of the financial system.

This legislation is not only a key measure for Hong Kong to implement its positioning as a "virtual asset center", but is also seen as a pioneering exploration of providing a legal identity for stablecoins at a time when the global regulatory landscape is still unclear. Unlike the United States and other places, which currently have a conservative attitude towards stablecoins or ambiguous regulations, Hong Kong is actively embracing Web3 innovation through institutional means to provide policy certainty for financial technology companies and cross-border payment platforms.

The industry generally believes that the advancement of this regulation will benefit the landing of mainstream stablecoin projects in Hong Kong, and is expected to attract stablecoin issuers with strong compliance awareness and who want to expand into the Asia-Pacific market. For example, if projects such as USDC and USDT want to officially provide services in Hong Kong in the future, they may choose to apply for a license or cooperate with local licensed institutions. In addition, if Hong Kong companies plan to issue Hong Kong dollar stablecoins (such as HKD-pegged tokens), they will also have a legal issuance path for the first time.

For Hong Kong itself, this regulatory system will help promote the upgrading of financial infrastructure. Stablecoins are considered to be an important bridge between traditional finance and virtual assets, and are expected to open up application space in cross-border settlement, retail payments, trade financing and other fields. In the future, once stablecoins are legalized and cooperate with the development of CBDC (central bank digital currency), a more flexible and efficient financial system may be formed.

The draft is currently in the legislative process and needs to be reviewed in detail and read three times before it can be officially implemented. If it is successfully passed, Hong Kong is expected to fully launch a stablecoin regulatory system by the end of 2025, and continue to consolidate its leading position in the global digital asset field.