BlackRock Launches Bitcoin (BTC) ETP After UK Lifts Trading Ban

BlackRock's iShares Bitcoin ETP debuted on the London Stock Exchange as UK regulators eased regulations on cryptocurrency-related investment products.

BlackRock launched a Bitcoin-related exchange-traded product (ETP) in the UK following the Financial Conduct Authority's (FCA) decision to ease restrictions on crypto investment vehicles.

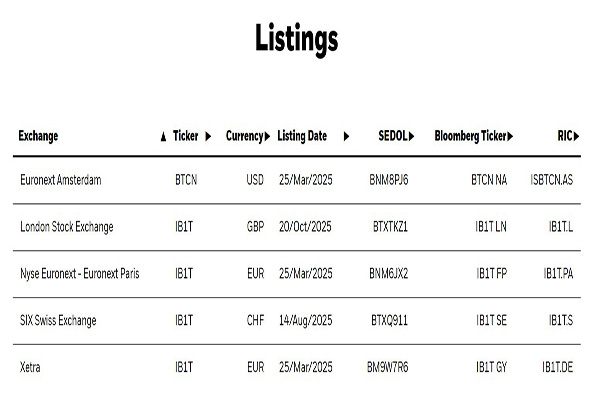

The asset management firm's website indicated on Monday that the iShares Bitcoin ETP had been listed on the London Stock Exchange. According to The Sunday Times, this product, structured as a Bitcoin-related security, will allow investors to purchase a portion of Bitcoin (BTC) through units starting at approximately $11.

The ETP is designed to mirror the price of BTC while trading within a regulated framework, allowing investors to participate in the crypto market through traditional brokerage accounts. It enables UK retail investors to gain exposure to Bitcoin without directly holding the asset or trading it on a crypto exchange.

BlackRock is one of the most successful issuers of Bitcoin-related ETPs. According to SoSoValue data, the company's iShares Bitcoin Exchange-Traded Fund (ETF) has over $85 billion in net assets.

iShares Bitcoin ETP listings include the London Stock Exchange. Source: BlackRock

UK FCA Relaxes Stance on Crypto-Related Investment Vehicles

The move comes weeks after the UK softened its stance on certain crypto-related ETPs. On October 9th, the FCA lifted a four-year ban on crypto exchange-traded notes (ETNs). The regulator said investors can now access these products through FCA-approved exchanges based in the UK.

David Geale, FCA Executive Director of Payments and Digital Finance, said the market has evolved since they restricted retail ETN access. He said the products are now more mainstream and easier to understand.

Crypto ETNs trade like other securities, with their underlying assets securely held by regulated custodians.

While the regulator softened its stance on ETPs, it said the retail ban on crypto asset derivatives will remain in place. However, the FCA added that it will closely monitor the market and consider its approach to these "high-risk investments."

In addition to ETNs, the UK also allows asset managers to tokenize funds using blockchain technology.

On October 14, the regulator said the move is intended to drive innovation and growth in the asset management sector, recognizing that tokenization has the "potential to drive fundamental change in asset management."