Cryptocurrencies plummeted across the board, with Bitcoin falling below $90,000, a daily drop of 5.86%, and over 170,000 people liquidated their positions in the past 24 hours.

On the morning of November 18th, the cryptocurrency market continued its sharp decline, with Bitcoin falling below the $90,000 mark. This is the first time Bitcoin has fallen below $90,000 in nearly seven months.

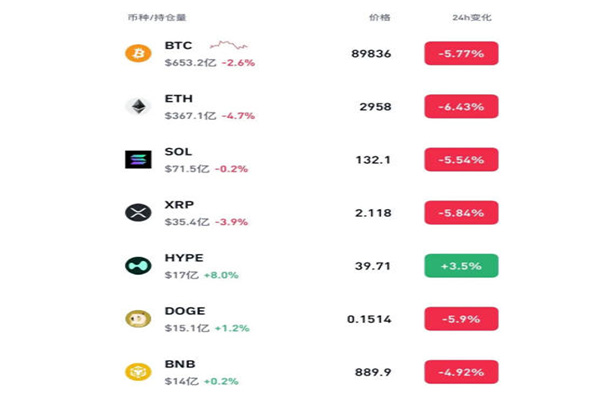

As of press time, Bitcoin was trading at $89,838.9 per coin, having reached a 24-hour low of $89,750 per coin, representing a daily drop of 5.86%.

Cryptocurrencies fell across the board, with Ethereum dropping below $3,000 to $2,958 per coin, a 6.43% drop in the last 24 hours; SOL was at $132.1 per coin, a 5.54% drop in the last 24 hours. Dogecoin and BNB also saw significant declines.

According to Coinglass data, over 175,000 cryptocurrency positions were liquidated in the past 24 hours, totaling $935 million. Of this, $650 million were long positions and $280 million were short positions.

Data shows that the current total market capitalization of cryptocurrencies has fallen to $3.187 trillion, a 2.4% decrease in the past 24 hours. Bitcoin's market share is currently 57.3%, and Ethereum's is 11.3%.

In terms of news, BitMEX co-founder Arthur Hayes stated in his latest blog post, "Snow Forecast," that Bitcoin's drop from $125,000 to the $90,000 range, while US stocks remain at historical highs, suggests that "a credit event is brewing."

Hayes pointed out that the dollar liquidity index has weakened significantly since July. If the market deteriorates further, the Federal Reserve, the Treasury, or other institutions will be forced to accelerate money printing to stabilize the market. During this period, Bitcoin may fall back to $80,000 to $85,000. However, once US liquidity expands again, Bitcoin will quickly reverse course and is expected to surge to the $200,000 to $250,000 range by the end of the year.