Autel Robotics unveils charging robot and advances cooperation with global autonomous driving giants

Autel is collaborating with a leading global company in the autonomous driving field to develop an automated charging network. This partner's core business is providing driverless autonomous taxi services.

NVIDIA and Lenovo have partnered to launch an AI-powered cloud super factory that will utilize Vera Rubin.

During CES 2026, NVIDIA founder and CEO Jensen Huang and Lenovo Chairman and CEO Yang Yuanqing jointly announced that the two companies will collaborate to launch the "Lenovo AI Cloud Super Factory".

China is reviewing whether there were any irregularities in Meta's $2 billion acquisition of Manus.

Chinese officials are reviewing Meta's $2 billion acquisition of artificial intelligence platform Manus, assessing whether there are potential export control violations.

Hong Kong-listed Guofu Quantum QFI channel expands into A-shares, strategically investing 127 million yuan in Jinfang Energy.

Hong Kong-listed Guofu Quantum QFI channel expands into A-shares, strategically investing 127 million yuan in Jinfang Energy.

Silver's market capitalization reached $4.63 trillion, surpassing Nvidia to become the world's second-largest asset.

According to the latest market data, the total market capitalization of precious metal silver has surpassed $4.63 trillion, officially overtaking NVIDIA, the world's leading chipmaker, to become the second-largest asset class globally.

Lenovo unveils next-generation AI PC, flagship Motorola smartphone, AI-sensing concept necklace, and concept smart glasses.

At a recent innovation and technology launch event, Lenovo showcased its future-oriented AI and smart device strategy, covering multiple core categories and attracting widespread industry attention.

xAI completes $20 billion Series E funding round, with strategic participation from NVIDIA and Cisco.

According to xAI's latest official announcement, its recently completed Series E financing round achieved results exceeding expectations.

Walmart has launched Bitcoin and Ethereum trading functionality through its OnePay app.

On January 6th, renowned cryptocurrency media outlet CoinDesk reported that global retail giant Walmart has officially integrated Bitcoin and Ethereum trading functionality into its digital payment application, OnePay.

Gate Group announces Gate Dubai launch; VARA licensing accelerates global hub-level expansion.

According to an official announcement, Gate Group has announced that its subsidiary, Gate Technology FZE (referred to as "Gate Dubai"), has officially launched operations.

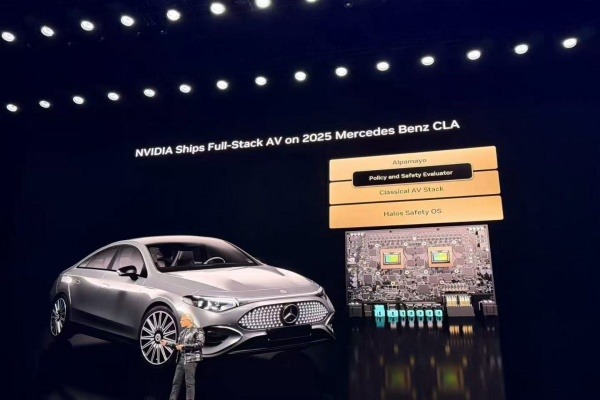

Citigroup: Nvidia's AI ecosystem will boost the growth of autonomous taxis.

A report released by Citigroup analysts stated that Nvidia's new-generation artificial intelligence platform, open models, and ecosystem are expected to spur demand for autonomous taxis and support global economic growth.

Matrixport: Macroeconomic and crypto synergies will trigger high volatility in 2026; Mt.Gox repayment and the pre-halving window are key milestones.

04 Jan 2026

Crypto venture capital investment is projected to surge 433% to $49.75 billion by 2025.

04 Jan 2026

NVIDIA and Lenovo have partnered to launch an AI-powered cloud super factory that will utilize Vera Rubin.

07 Jan 2026

Lenovo unveils next-generation AI PC, flagship Motorola smartphone, AI-sensing concept necklace, and concept smart glasses.

07 Jan 2026

Silver's market capitalization reached $4.63 trillion, surpassing Nvidia to become the world's second-largest asset.

07 Jan 2026

China is reviewing whether there were any irregularities in Meta's $2 billion acquisition of Manus.

07 Jan 2026