U.S. Treasury Secretary Bessant: The U.S. dollar will soon be on the blockchain, and the GENIUS Act will consolidate the dollar's position as a global reserve currency for generations to come

Blockchain technology will power the next generation of payments, and the U.S. dollar is about to be put on the blockchain thanks to Trump’s leadership and the important work of Senator Bill Hagerty in Congress.

Volcon, a listed company, purchased 280.14 bitcoins for the first time and completed over $500 million in private financing to purchase bitcoins

On July 22, Volcon, a US-listed electric vehicle company, purchased 280.14 bitcoins for the first time and completed more than $500 million in private placement financing for the purchase of bitcoins.

Chu Tianlong: Plan to provide cross-border settlement solutions combining stablecoins and SIM cards for partner banks

Chu Tianlong held an online exchange meeting for investors. An institutional investor asked: What progress has the company made in the digital currency business in the first half of this year?

SoftBank and OpenAI's $500 billion AI project has a rocky start

People familiar with the matter said SoftBank and OpenAI had disagreements over key terms of their collaboration on Stargate, including the location.

Musk's new idea! Children's AI application "Baby Grok" is about to be launched

Musk announced through the social platform X that his artificial intelligence company xAI is developing a new app called "Baby Grok". This app is designed for children and aims to provide a friendly digital environment for children.

OpenAI CEO proposed the “100-fold expansion” plan for the first time: more than 1 million GPUs will be online by the end of 2025!

CEO Sam Altman recently announced on social media that OpenAI plans to launch more than 1 million GPUs by the end of 2025. This ambitious "100-fold expansion" technology vision is eye-catching.

Strategy's market value soared to US$128.5 billion, an increase of more than 60 times in five years

The market value of Strategy, a US listed company, soared to $128.5 billion after yesterday's close, setting a record high and ranking among the top 100 US listed companies by market value for the first time.

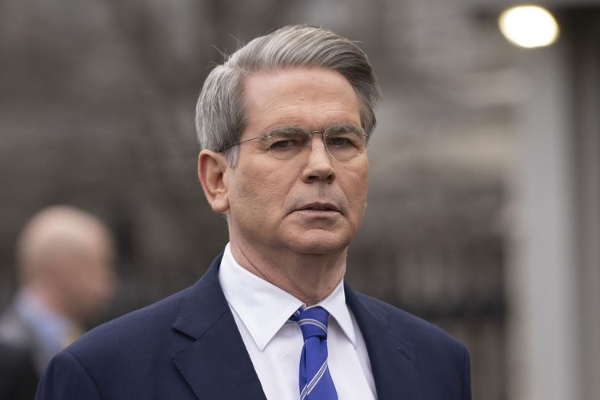

SEC Chairman: Considering “Innovation Exemptions” to Promote Tokenized Securities

Paul Atkins, chairman of the U.S. SEC, said that the SEC is considering establishing an "innovation exemption" mechanism to encourage the market to advance the development of asset tokenization under the existing regulatory framework.

Thumzup increases its cryptocurrency layout, and its investment portfolio covers mainstream currencies such as BTC, ETH, and XRP

Thumzup Media announced that the company’s board of directors has officially authorized it to hold up to $250 million in cryptocurrency assets, marking the company’s official entry into the digital asset strategic allocation stage.

Trump plans to sign executive order: to include cryptocurrencies, gold and other assets in the $9 trillion retirement market

US President Trump is preparing to sign a major executive order to include alternative assets including cryptocurrencies, gold and private equity in the US $9 trillion 401k retirement market. If this policy is officially implemented

India launches ChatGPT e-commerce payment pilot

10 Oct 2025

Binance ATOM fell to $0.001 in the early morning

11 Oct 2025

Crypto markets are experiencing extreme market conditions! BTC and ETH both saw their maximum drop exceed 12% within 30 minutes.

11 Oct 2025

Citigroup CEO says he supports tokenized deposits, stresses market focus on stablecoins

15 Oct 2025

AI Web3 recruitment platform TradeTalent secures $8 million in funding

20 Oct 2025

The total amount of liquidation in the past 24 hours was US$19.133 billion, the highest single-day liquidation amount in history.

11 Oct 2025